Stefanie Cadou

Courtier immobilier résidentiel

Mobile: 514.885.3524

Phone: 514.481.0241

Senior Living Home Transitions, Simplified with Stefanie

Stefanie in the News

A house is rarely a pension fund

Marie Eve Fournier

Actual News Magazine November 27, 2023

The idea that when you retire you will rush to sell your house that has become too big and requires too much maintenance is just a pipe dream. The vast majority of seniors choose to age in place for as long as possible, until their children eventually step in or their health forces them to move for care.

Real estate broker Stéfanie Cadou is very well placed to know this. She specializes in “seniors in transition”. Its clientele is made up of 98% elderly people who are selling their homes, a very stressful stage of their lives. Psychologists compare moving to bereavement and job loss, even among 35-year-olds…

Most of the time, seniors who put their house up for sale have lived there almost their entire adult life, for 40 or 50 years, they raised their children there, and accumulated tons of things and memories. Leaving therefore becomes an ordeal as difficult emotionally as it is physically, the broker from Royal LePage Village in Montreal told me. “Unfortunately, this causes people to postpone moving. »

Stéfanie Cadou uses the word “unfortunately” because she sees clearly that the fear of changing one’s living environment, as legitimate as it may be, ends up harming the health of seniors. Falls are very common in homes with stairs and bathrooms that are more or less well adapted to the loss of physical abilities. The average age of its customers is close to 85 years old.

Real estate broker Stéfanie Cadou from Royal LePage Village, in Montreal

The elders stretch the elastic as much as possible, and this is normal. In the majority of cases, it is their children who take the steps to sell the family home and manage the laborious pruning process.

The Canada Mortgage and Housing Corporation (CMHC) recently became interested in the behavior of seniors in the real estate market. Her data goes exactly in the same direction as Stéfanie Cadou’s observations in the field: a “large proportion of elderly households” prefer to age in their house rather than sell it. The attraction for condos and the rental market does exist, but it is “very limited”.

Let’s look at the numbers.

In 2016, almost 467,000 households aged 75 to 79 owned property in Canada. Five years later, this group, now aged 80 to 84, owned 366,000 homes. These approximately 100,000 sales mean that one in five households in this cohort have sold. This is little. The “sales rate”, to use CMHC’s expression, climbs to 93.5%… but only among 95 to 99 year olds!

In other words, the paid-off house is far from being the equivalent of a retirement plan from which one draws income from the age of sixty. In reality, very few households sell their property to live off the proceeds of the sale.

This is in no way surprising, from my point of view, because you have to find somewhere to relocate, and no option is perfect.

Condos come with monthly fees, transfer taxes (the “welcome tax”), school and municipal taxes, special contributions for major work in certain cases and more responsibilities. Given the current high price of condos, staying in your paid-up home may be more economical unless you move to a less expensive market. For their part, housing represents risks of eviction and rent increases. As for RPAs, private residences for independent seniors, they are often perceived as depressing places rather than cruise ships, in addition to being particularly expensive.

Although the number of elderly people will jump in the coming years, we should not expect this to cause a wave of new homes on the market.

Seniors eventually move out, but at such an advanced age that the tsunami of properties for sale is far from imminent, warns CMHC. In short, young people should not count too much on this to see an increase in the supply of houses in the coming years which could cause a decrease in prices.

This is all the more true as increasing life expectancy constantly pushes back the time when seniors decide to sell their homes. Improving health is another factor. Staying in shape longer allows you to maintain your home and land. It also turns out that baby boomers have greater financial assets than the previous generation, so they have less need to sell to fund their retirement.

Seniors who lack funds or who want to increase their income to travel can take out a reverse mortgage or take advantage of their mortgage margin. But these two methods of transforming your home into a retirement plan are not a panacea.

Source

Canadians are combining their buying power and co-owning homes with family and friends to combat unaffordability

Royal LePage Blog

High property prices, elevated interest rates and the rising cost of living has prompted many Canadians to rethink their lifestyle and housing needs. For some, this means pooling financial resources with other family members and friends in order to gain access to the housing market. By co-owning a property (with someone other than their spouse or significant other), homebuyers can not only divide the expense of homeownership among more people, but potentially access larger homes in more desirable locations that they may not have been able to afford on their own.

According to a recent Royal LePage survey1 conducted by Leger, 6% of Canadian homeowners2 co-own their property with another party, not including their spouse or significant other. Of this group, 89% co-own with family members and 7% with friends. Another 8% co-own with someone who is not a friend or family member.

Seventy-six per cent of co-owners say that affordability was a major motivating factor in their decision to co-purchase their property. Not surprisingly, that number rises to 83% for co-owners between the ages of 25 and 34.

“Households group together for many reasons, including communal care for elderly parents, help raising children, cultural preferences or simply to be together. However, the decision to live together, including co-owning a home, is a decision increasingly made for financial reasons,” said Karen Yolevski, COO, Royal LePage Real Estate Services Ltd. “In an environment where home prices and interest rates have risen quickly and sharply, and where the threshold to qualify for a mortgage has become much more challenging, Canadians are pooling their resources and buying homes together. In cases where homebuyers cannot afford to purchase on their own, they are combining their buying power with their parents, children, siblings or even friends.”

Concerning their co-owning situation, 44% of co-owners3 say that they and all fellow co-owners live in the home together. A smaller percentage (28%) say that they co-own a home with another person(s), but they do not cohabitate. Six per cent of respondents say that they co-own a home with another person(s) and neither party uses the home as a primary residence, rather as an investment or recreational property.

According to Stéfanie Cadou, residential real estate broker, Royal LePage Village in Montreal, cohabitation combinations are becoming increasingly diversified these days in order for buyers to gain access to home ownership, which for some means letting go of the option to live in complete solitude, a trend that emerged for many households during the pandemic and has remained permanent for some.

“The decision to buy jointly with family or friends nevertheless requires careful thought and the establishment of clear rules for living together,” said Cadou. “Preparing a cohabitation agreement – ideally notarized – can be beneficial to ensure that rules and obligations are respected by all parties. It is also essential to provide private and common living spaces so that all co-owners can pursue their respective daily routines without encroaching on each other.”

Here are a few highlights from the 2023 Canadian Co-owners Survey:

Almost one third (32%) of co-owners who were motivated by low affordability purchased their home after the Bank of Canada began raising interest rates in March of 2022

Nearly two-thirds (65%) of Canadian co-owners say they own a single-family detached property

56% of co-owners co-own a home with their parent(s) or parent(s)-in-law; 18% co-own with their adult child(ren)

1An online survey of 501 Canadians 18+, who co-own their home with someone other than their spouse, was completed between August 10, 2023, and August 21, 2023, using Leger’s online panel. No margin of error can be associated with a non-probability sample (i.e., a web panel in this case). For comparative purposes, though, a probability sample of 501 respondents would have a margin of error of ±4.4%, 19 times out of 20. N.B. Participants could co-own with a spouse, but must co-own with someone other than their spouse as well.

2Sample was weighted based on age, gender, and region according to current census data and incidence of home co-ownership was calculated using Q1 and Q2 responses

3In the survey, co-owners are defined as an individual person or a couple who own a property with another person or persons

DATA CHART

West Island seniors receive free iPads before the holidays

The free iPads will improve the quality of life of senior residents and their families.

Some West Island seniors received an early Christmas present Wednesday when free iPads were distributed at local CHLSDs.

The “iPads for Seniors’ Residences” campaign was an initiative of Lianas Senior Transition Support, in collaboration with West Island Community Shares (WICS)...

Dynamic couple step up to help seniors in need of communications devices

" When the COVID-19 pandemic first hit last spring, senior homes in Laval were particularly hard hit.

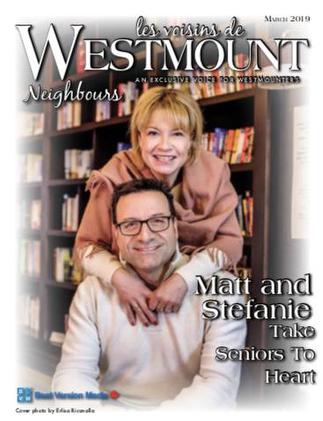

CJAD host Matt Del Vecchio of Life Unrehearsed and his wife Stefanie Cadou have launched their Go Fund Me campaign to provide new iPads for seniors residences in need..... Funds raised will go directly to the purchase of iPads. They will be hand delivered to seniors residences that will benefit from the generosity of donors." ..

Featured in the March 2019 issue of Westmount Neighbours magazine!

Click to download the March 2019 issue

A hard goodbye: Seniors often need help to sell the family home

It’s familiar, comfortable — and (hopefully) paid off. But without the momentum of an impending move, it’s all too easy to put off planning for an eventual change.

When you’ve been in the same home for 40 or 50 years, stuff tends to pile up.

Over the years, mementoes and bric-a-brac gather in dusty corners of basements, attics, garages, spare rooms, cupboards and closets, everything from boxes of forgotten family photos to the long-disused bins of camping equipment and bags of the children’s old toys.

One day you’ll go through it all, you promise yourself. You’ll have a big garage sale. You’ll box the best of it up and give it to the kids. You’ll donate the rest to charity. One day.

Days have a way of running out. Wait too long, and when “one day” comes, you may be physically incapable of making it down the stairs to the basement or lifting heavy boxes of books. Financial difficulties, illness, injury or death may impose new deadlines, adding another layer of stress to an already overwhelming task.

Many seniors prefer to stay in the family home as long as possible. It’s familiar, comfortable — and (hopefully) paid off. But without the momentum of an impending move, it’s all too easy to put off planning for the inevitable day when circumstances force a change.

Stefanie & Lianis Services: Aging at Home or Making a Move : Life Unrehearsed CJAD

Stefanie, Matt and Corrie discuss the delicate choice of aging well at home or making a move.

Stefanie, Matt and Corrie discussInvited as guests to speak on CJAD 800 am radio

Behind the Scenes !

Matt and I working hard planting the signs

The Inspiration for my work, my dear Grandmother